Save time and money, file your taxes online

Specialized Online Tax Help for 1099 NEC Contractors, 1099 B Investors, and More

Expert services for your needs

At PaperWerks, we specialize in tax preparation services tailored to the unique needs of independent contractors, investors, rental property owners, and EITC clients. Located in Texas, our dedicated team understands the complexities of your financial situation and provides personalized solutions to maximize your returns. We simplify the tax process, ensuring you get the support you need, when you need it. Let us handle your taxes, so you can focus on what you do best.

our services

At PaperWerks, we handle standard tax returns for individuals and families, including those eligible for Earned Income Credit. However, our true expertise lies in providing specialized tax preparation services for 1099 contractors, real estate investors, and Bitcoin & stock market investors.

Let us help you navigate the complexities of your unique tax situation with confidence!

Individuals & Families

Tax Preparation Services for Individuals & Families

1099-NEC Tax Preparation

Expert Tax preparation for independent contractors and freelancers.

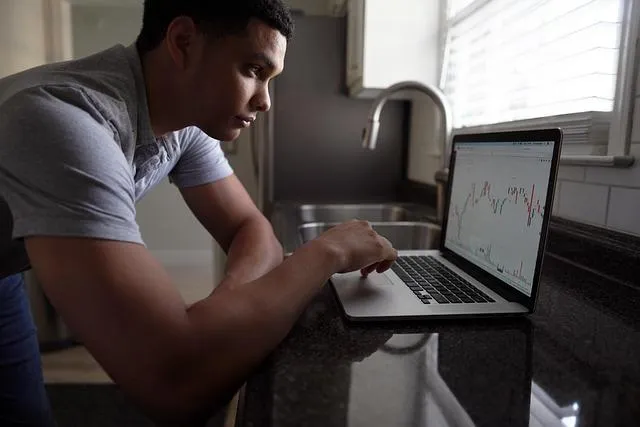

Investor Tax Filing

Comprehensive tax solutions for rental property owners.

Rental Property Tax Services

Comprehensive tax solutions for rental property owners.

Tax Services for Small Businesses and Startups

Focus on tax planning, compliance, and deductions specific to small businesses, startups, and entrepreneurs.

Our Clients

Feedback from our delighted clientele.

PaperWerks made my tax filing experience seamless and stress-free. As a contractor, I always struggled with the complexities of 1099-NEC forms, but their team guided me through every step. Their expertise gave me peace of mind, knowing my taxes were handled correctly. I can finally focus on my work instead of worrying about tax season. Highly recommend their services for anyone in the gig economy looking for reliable assistance!

Brandon Vega

Self-employed

As an investor in cryptocurrency and stocks, I needed a tax preparation service that understood the nuances of my investments. PaperWerks exceeded my expectations by providing detailed insights into how to report my earnings accurately. Their knowledgeable staff took the time to answer all my questions, ensuring I felt confident throughout the process. I am grateful for their personalized approach and commitment to excellence. If you're an investor, PaperWerks is the way to go!

Chris Wei

CryptoInvestor LLC

Being a rental property owner can complicate tax preparation, but PaperWerks made it incredibly straightforward. Their team understood the intricacies of rental income and deductions, helping me maximize my tax benefits. They were responsive and attentive, making sure I felt supported every step of the way. I appreciate how they took the time to explain everything clearly. PaperWerks has become my go-to service for all my tax needs, and I can't thank them enough!

Karen Weiss

Real Estate Solutions

FAQS

What is the difference between itemizing and taking the standard deduction?

Itemizing your deductions allows you to deduct specific expenses, such as medical expenses, charitable contributions, and state and local taxes. The standard deduction is a fixed amount that you can deduct without having to itemize your deductions.

What is the Earned Income Tax Credit (EITC)?

The EITC is a tax credit that is available to low- and middle-income workers. The EITC can reduce your tax liability or even give you a refund, even if you owe no taxes.

What should I do if I am audited?

If you are audited by the Internal Revenue Service (IRS), you should contact a tax professional immediately. A tax professional can help you understand the audit process and can represent you before the IRS.

Our Team

Our team of tax professionals is dedicated to helping you get the maximum refund you're owed and to ensure that your taxes are filed accurately and on time. We have a wide range of experience and expertise, and we are committed to providing you with the highest quality of service and support.