Simplify Your Investment Tax Filing with PaperWerks

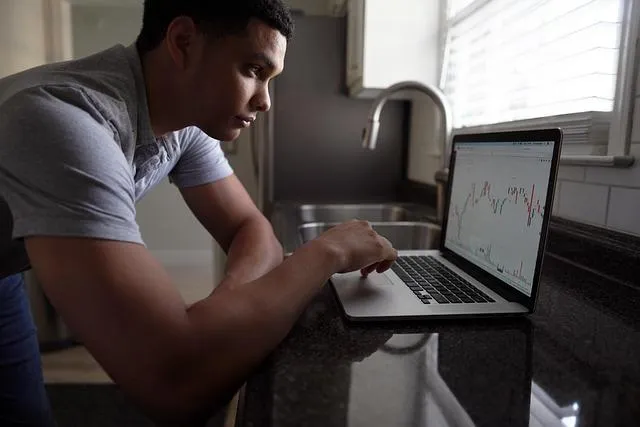

Investing opens doors to financial growth, but it also brings unique tax complexities that can be overwhelming. At PaperWerks, we specialize in tax filing services tailored for investors—whether you’re trading cryptocurrency, options, stocks, or bonds.

Our experienced team keeps up with the latest tax laws to ensure every detail of your investment activity is reported accurately and compliantly. We work to maximize your eligible deductions and minimize your tax liability, so you can focus on growing your portfolio with confidence.

Trust PaperWerks to make your investment tax filing straightforward and secure your financial peace of mind.

Investors Tax Filing

Investing can be a rewarding venture, but it comes with its own set of tax challenges. PaperWerks offers specialized tax filing services for investors dealing with cryptocurrency, options, stocks, and bonds. Our dedicated professionals stay updated on the latest tax laws and regulations, ensuring your investments are accurately reported and compliant. We analyze your investment transactions to maximize potential deductions and minimize your tax burden. With our expertise, you can navigate the tax implications of your investments confidently. Choose PaperWerks to simplify your investment tax filing and safeguard your financial future.

FAQS

What is the difference between itemizing and taking the standard deduction?

Itemizing your deductions allows you to deduct specific expenses, such as medical expenses, charitable contributions, and state and local taxes. The standard deduction is a fixed amount that you can deduct without having to itemize your deductions.

What is the Earned Income Tax Credit (EITC)?

The EITC is a tax credit that is available to low- and middle-income workers. The EITC can reduce your tax liability or even give you a refund, even if you owe no taxes.

What should I do if I am audited?

If you are audited by the Internal Revenue Service (IRS), you should contact a tax professional immediately. A tax professional can help you understand the audit process and can represent you before the IRS.